It never seems to fail. These Wall Street investment strategists just seem to always be chasing their tails.

Markets Decline -> Wall Street adjusts forecasted price targets lower.

Markets Rally -> Wall Street adjusts forecasted price targets higher.

On April 17th of this year, after the markets experienced a quick, severe decline following President Trump’s “Liberation Day” tariff announcement, I called attention to Wall Street strategists reducing their year-end target for the S&P 500 Index. As what seems to be the norm, strategists reduced their price targets after the significant decline of the S&P 500 Index.

You can read the my post here: Wall Street Strategists’ Guesses Follow Markets Lower – April 17, 2025

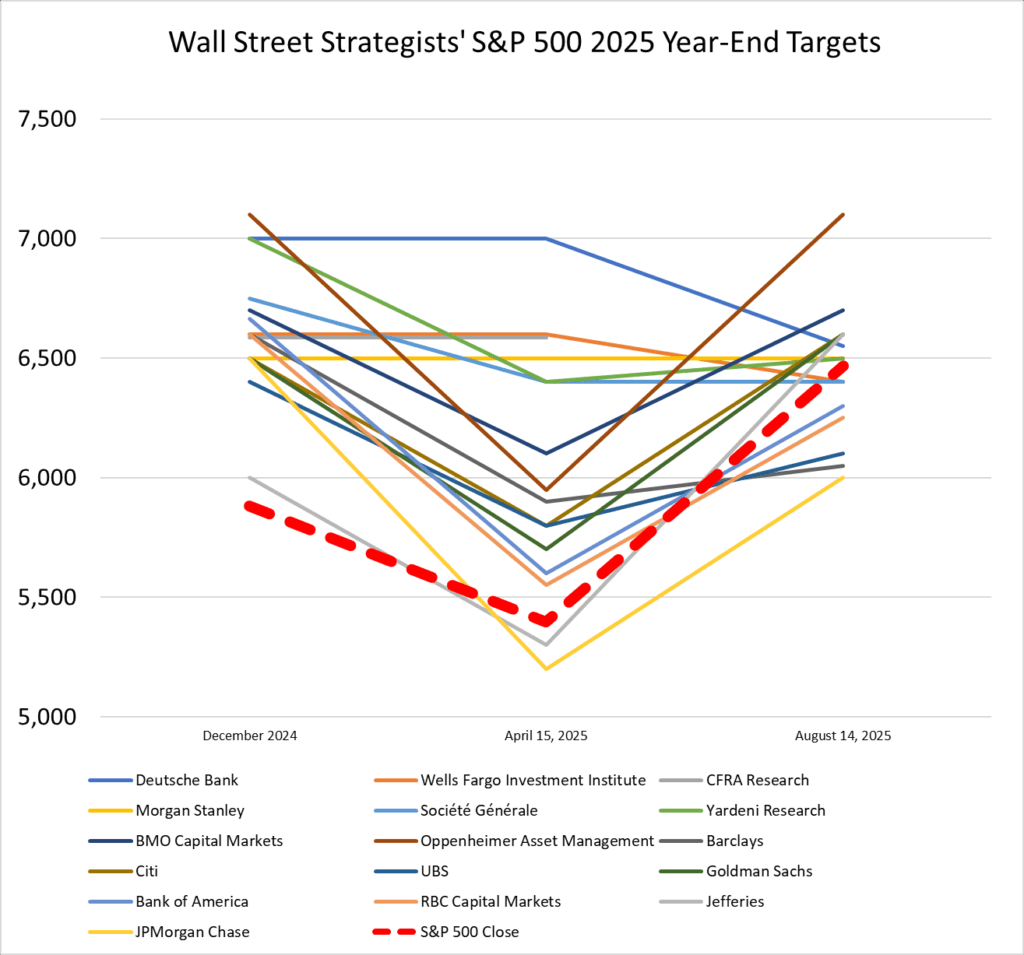

After many investment strategists reduced their year-end price target for the S&P 500 Index, the S&P 500 has significantly rallied from its lows and has continued to reach new all-time highs. As the S&P 500 Index has rallied higher, Wall Street strategists have been chasing the market and raising their year-end price targets to try to keep up. Where were these “strategists” bullish targets when the equity markets were at the lows in April???

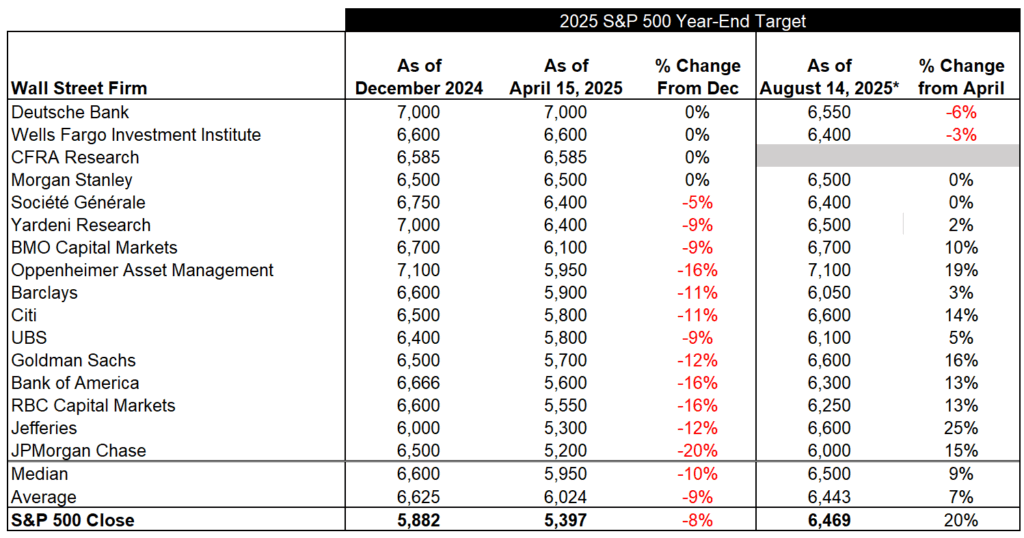

Here are updated forecasts from various Wall Street strategists as of August. Some firms appeared to have higher conviction in their forecasts without significant adjustments, while others were whipsawed and seem to be chasing the markets around.

Here is the chart of the S&P 500 Index that I showed from my April 17th post…

…and here is the most recent chart of the S&P 500 Index…

Here’s a visual of the strategists’ changing year-end price forecasts for the S&P 500 Index…

I’ve called attention to Wall Street chasing the markets higher and lower in my previous posts. These strategists try to keep their forecasts somewhat in-line with what the market is doing at that moment in time so they don’t look too far off from everyone else. I understand the challenge of these strategists’ jobs and trying to predict the unknown future, but c’mon.

You can read my previous posts and personal issues with these Wall Street strategists’ forecasts over time here…

- Wall Street Strategists’ Guesses Follow Markets Lower April 17, 2025

- Wall Street Strategists’ Forecasts 2024/2025 January 5, 2025

- Market Rallies -> Strategists Raise Forecasts May 21, 2024

- Wall Street Strategists’ Guesses for 2024 January 14, 2024

- Wall Street Strategists’ 2023 Forecast Review – Ouch! January 9, 2024

- Wall Street Strategists’ 2023 Outlook (Guess) January 15, 2023

I hope investors didn’t blindly follow the Wall Street strategists’ forecasts in April. For those investors (or maybe I should call them “traders”) that reduced exposure to the equity market in April and failed to participate in the subsequent rally from the April lows, these investors (traders) may be facing capital destruction as they may not get a chance to get back in the market at the same prices when they got out of the market.

The emotional reactions of following of the market instead of leading or letting the markets come to you it is just another example of why investors should consider focusing on the long-term potential of investing, not trying to time the markets over shorter periods of time. This emotionally-driven response — selling low due to fear and buying higher due to feeling the market is better or a fear of missing out (FOMO) — can be a recipe for disaster.

This is why I focus on longer-term investing for managing my own wealth and the wealth of my clients.

Sources

- MarketWatch. Wall Street forecasters keep raising the S&P 500’s targets. Should investors buy the hype? Wang. August 15, 2025. Retrieved from: https://www.marketwatch.com/story/wall-street-forecasters-keep-raising-the-s-p-500s-targets-should-investors-buy-the-hype-0c423158

- *Reuters. Jefferies raises S&P 500 annual target to 6,600 on resilient earnings. Jose. August 25, 2025. Retrieved from: https://www.reuters.com/business/jefferies-raises-sp-500-annual-target-6600-resilient-earnings-2025-08-25/

- *JPMorgan. Mid-Year Outlook. July 1, 2025. Retrieved from: https://www.jpmorgan.com/insights/global-research/outlook/mid-year-outlook

Eric Kulwicki, CFA®, CFP®, brings 20+ years of experience, currently serving as an independent investment consultant, portfolio manager, and wealth advisor for institutional and retail clients. On KulwickiInsights.com, Eric shares his timely perspectives on financial markets, investment strategies, and other financial topics. He also offers online investment education courses for beginner and intermediate investors, and coaching sessions for DIY investors seeking professional guidance.