Diversified Global Investors Were Rewarded in Q4 and 2025

Diversified global investors were rewarded in Q4 and throughout 2025. The year witnessed a significant shift where foreign equities outperformed domestic markets, precious metals outperformed equities, and the U.S. dollar weakened against foreign currencies.

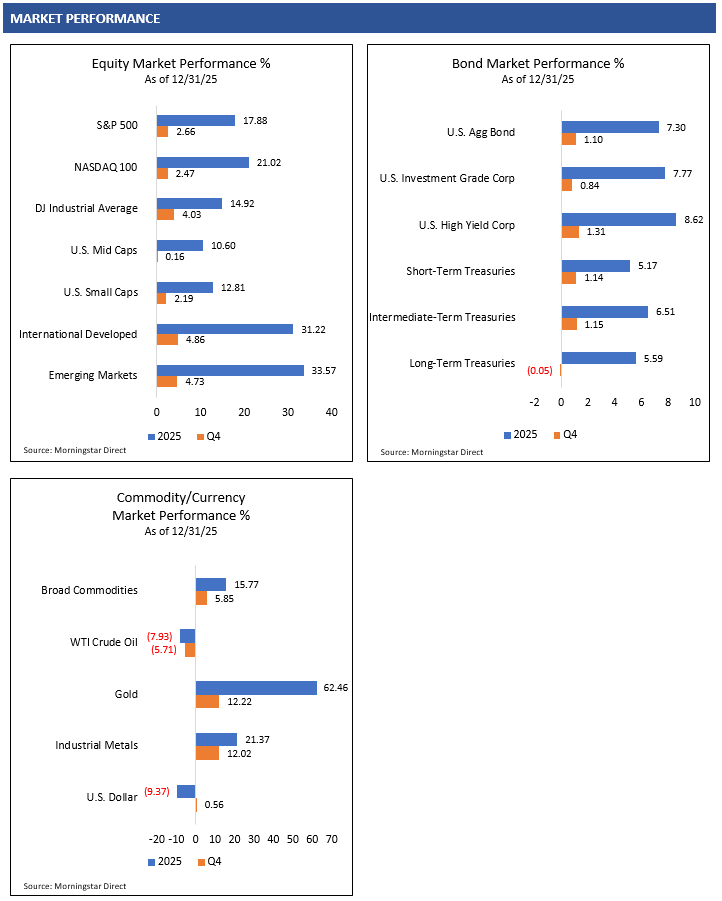

In the U.S., the S&P 500 Index rose 2.66% in Q4 and 17.88% for the year. Foreign equity markets displayed even stronger performance, as the MSCI ACWI ex USA Index gained 5.05% in the quarter and surged 32.39% in 2025. Bonds also delivered solid returns as the Bloomberg U.S. Aggregate Bond Index returned 1.10% for the quarter and 7.30% for the full year.1

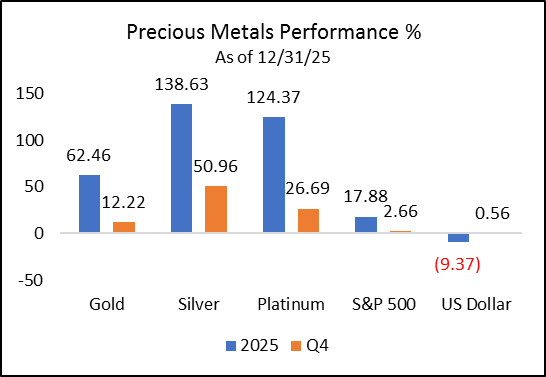

One of the most surprising and strongest-performing asset classes was precious metals. The Bloomberg Gold Subindex rallied 12.22% in the quarter and 62.46% for the year. Silver outperformed gold as the Bloomberg Silver Subindex rallied 50.96% in Q4 for a significant 138.63% return in 2025.1

Speculative momentum in 2025 at least partially drove significant asset appreciation across artificial intelligence and precious metals, and through risk-taking in unprofitable companies. Investors may need to exercise greater selectivity in 2026 as this speculative froth could fade and require a renewed focus on fundamentals.

The investment landscape for 2026 continues to be defined by resilience and the Fed’s monetary transition. We have moved from an era of combating high inflation with Fed tightening to a period of moderate inflation and normalized interest rates. This shift is supported by an underlying economy that remains fundamentally strong. Financial markets could continue to reward investors if the strong economic environment can persist throughout the new year.

U.S. Economic Strength Continues

The U.S. economy continues to show strength as the initial Q3 Real GDP growth estimate measured 4.3%. Key drivers included resilient consumer activity, exports and government spending. While business investment in artificial intelligence provided a major boost, private investment in manufacturing and wholesale trade lagged. A decline in imports further benefited the strong GDP number for Q3.2

The recent rally in financial markets can also have a meaningful wealth effect by strengthening household balance sheets. This primarily benefits middle- and upper-income households that hold financial assets. As net worth expands, these consumers feel empowered to sustain discretionary spending regardless of volatility in other economic sectors. This wealth-supported consumption can act as a stabilizer for the broader economy and support corporate earnings.

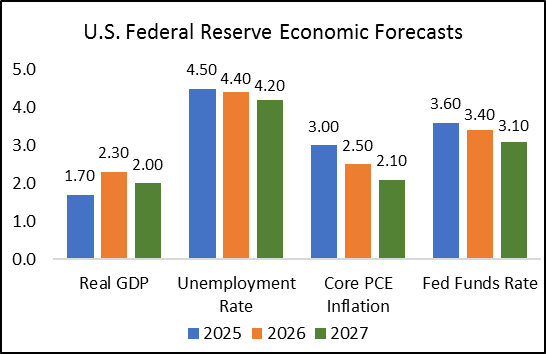

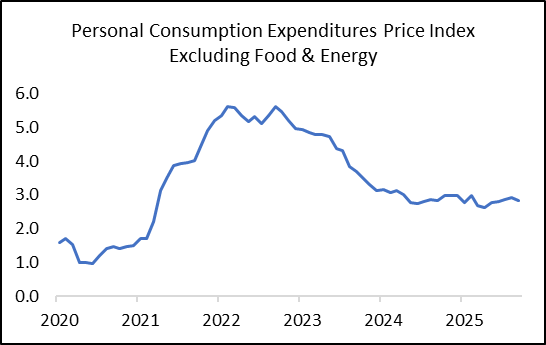

Resilient economic growth and controlled inflation could provide a constructive backdrop for financial markets in 2026. If economic growth results in inflation above the Federal Reserve’s 2% long-term target, the Fed could keep the fed funds rate higher for longer. We did not see a sustained downtrend in inflation throughout 2025. Inflation has remained within the 2.5%-3.5% range, which has been persistently above the Fed’s 2% target.

Although economic growth is anticipated to persist, the Federal Reserve forecasts diminishing inflation pressures throughout 2026 and 2027. If the data aligns with these projections, the Fed could resume cutting interest rates at some point in 2026.

Corporate Earnings Growth to Remain Solid

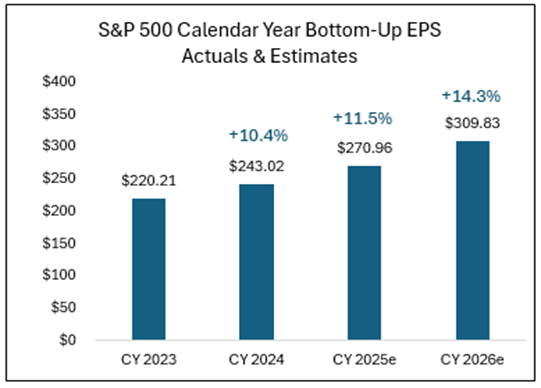

Global corporate earnings growth is anticipated to remain strong in 2026. In the U.S., FactSet consensus estimates project S&P 500 Index earnings per share growth of 14.3% in 2026. This is an acceleration compared to the 11.5% growth estimated for 2025.5

Middle- and upper-income households continue to demonstrate financial resilience. This stability is critical because consumption comprises nearly 70% of U.S. GDP. Elevated concerns remain due to a softening labor market and sticky inflation that could pressure the finances and confidence of lower-income households in the near term.

Business spending on artificial intelligence infrastructure remains strong. This secular AI theme could be just beginning. Investor focus may soon rotate from AI capital spending toward identifying tangible productivity gains and earnings growth for businesses effectively deploying these powerful tools.

As significant capital chases AI-centric themes, equity valuations in this space may be extended in the short term. Concrete productivity and earnings evidence will be needed for investors to maintain their confidence rather than just relying on speculation and hype.

Policy Uncertainty and Political Risks

In Q4, the U.S. government endured a 43-day shutdown, which marks the longest in history. Although this did not materially damage the economy or the financial markets, partisan conflict has not abated and remains a key risk factor for 2026.

The One Big Beautiful Bill Act passed in 2025 was designed to stimulate economic activity through tax cuts and accelerated business investment incentives. This legislation could be a powerful tailwind for consumers and businesses that supports durable economic expansion and strong corporate earnings growth.

Washington’s failure to renew Affordable Care Act health insurance premium subsidies may trigger a sharp rise in premiums that effectively reduces disposable income for millions of households. This surge in added expenses could act as a drag on discretionary spending power. If these subsidies are not extended or legislation is not passed to curb insurance premium costs, softer consumer spending could negatively weigh on the economy, corporate earnings, and ultimately the financial markets.

Trade tariffs remain a complex factor for investors to navigate in 2026. The Supreme Court is expected to rule on whether President Trump’s tariffs are legal as currently implemented. If they are revoked, market volatility could pick up again. The White House may need to restructure the tariffs under different statutes and adjust accordingly. This persistent trade unpredictability could force companies to remain cautious with business planning and might delay economic activity.

The November midterm elections will likely dominate financial headlines in 2026. Markets historically exhibit volatility in the months leading up to the vote due to heightened policy uncertainty. Investors often view divided government favorably because legislative gridlock prevents drastic changes that disrupt business conditions. Current political projections suggest Democrats may gain a majority in the House of Representatives while the Republicans retain the Senate. This political shift could trigger market volatility if investors begin pricing in a less favorable corporate environment should Republicans lose the majority leadership in Congress.

Monetary Policy: The Fed and the Yield Curve

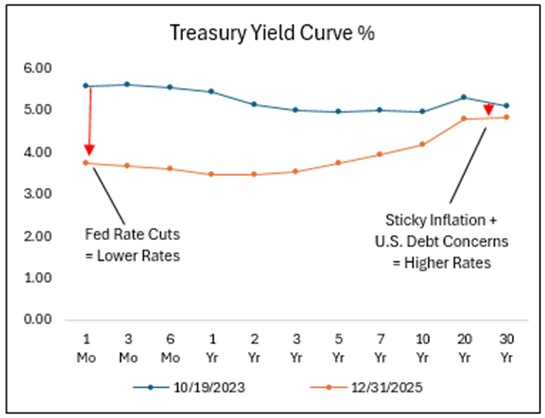

As was widely anticipated, the Federal Reserve lowered the fed funds rate target range by 25 basis points (0.25%) to 3.50%-3.75% in December. This marked a total reduction of 75 basis points in the fed funds rate for the year, following similar reductions in September and October.

Fed policymakers signaled that rate cuts might be on hold for now as economic growth appears durable and inflation is projected to moderate further. Financial markets are pricing in between one and three additional rate cuts in 2026. This suggests that while the easing cycle has continued, the Fed will likely proceed with caution from here.

The Fed will continue monitoring the labor market for signs of material weakness. An uptick in the U.S. unemployment rate to 4.6% in November was notable but remains at the lower end of its long-term historical range.

Fiscal debt concerns remain a persistent headwind for the economy. Federal leverage is high and accelerating, representing a structural issue that markets cannot ignore indefinitely. The Department of Government Efficiency (DOGE), established in early 2025 with a mandate to reduce federal spending and improve operational efficiency, no longer appears to be a priority for President Trump’s administration. The U.S. government’s debt is a long-term anchor that could drag on growth if bond vigilantes demand significantly higher yields. If U.S. debt levels continue to expand, interest rates along the yield curve may fail to reach sustainably lower levels from here.

Q4 Market Review

Equity Markets

Global equity markets finished strong in the fourth quarter. International equity markets continued their year-long trend of outperforming the U.S. market in 2025.

The S&P 500 Index gained 2.66% and the tech-heavy NASDAQ 100 rose 2.47% in Q4. While U.S. mid and small caps generally posted positive returns, they lagged larger companies in the quarter. International equity momentum remained strong in Q4 as the MSCI EAFE Index, which measures developed markets’ equity performance, jumped 4.86% and the MSCI Emerging Markets Index rallied 4.73%.1

Global equity investors captured strong rewards in 2025 yet significant price appreciation outpaced actual corporate earnings growth. This multiple expansion pushed equity valuations higher in the U.S. and internationally. Investors must now carefully weigh the long-term potential for future corporate earnings growth against the near-term risks associated with these now elevated equity valuations.

The 2025 market environment was a bit bifurcated. Strong fundamentals drove outperformance in artificial intelligence-related stocks while mining companies rallied alongside precious metals. There were also significant gains among lower-quality companies. The outperformance of lower-quality companies’ stocks could be a potential warning sign of speculative froth building in the financial markets.

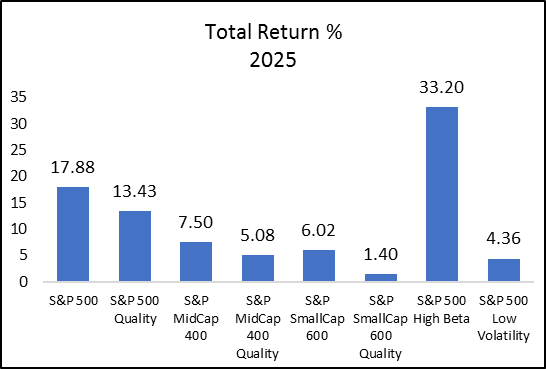

As the chart below illustrates, equity indices focused on higher-quality companies with consistent profitability and healthy balance sheets generally underperformed. High beta stocks, often linked to momentum and speculation, also significantly outperformed throughout 2025. Investors will need to determine if this outperformance in lower-quality companies and high beta stocks can persist or if fundamentals will ultimately dictate returns in the new year.

Bond Markets

Fixed income markets provided a steady environment for investors in Q4. Income generation rather than price appreciation served as the primary driver for bond returns in the quarter. The investment-grade Bloomberg U.S. Aggregate Bond Index returned 1.10%, while investors willing to accept higher credit risk saw the Bloomberg High Yield Bond Index gain 1.31% in Q4.

The Federal Reserve lowered the overnight federal funds rate twice in Q4 for a total of 50 basis points (0.50%). The broader bond market had largely priced in these rate cuts already and Treasury yields remained range-bound throughout the rest of the yield curve for the quarter.

The U.S. government shutdown during October and November briefly elevated bond market volatility and credit spreads widened slightly. Sentiment recovered quickly once the political stalemate was resolved and credit spreads compressed back to historically tight valuations.

A resilient economic landscape and solid corporate earnings environment could continue throughout 2026. This constructive backdrop could keep investors supporting credit-sensitive bonds. With tight credit spreads and the Fed potentially getting closer to the end of its interest rate cutting cycle in 2026, bond income generation could serve as the primary driver of total return for the year ahead.

Commodity Markets

Precious metals outperformed many major asset classes throughout 2025. Gold, often viewed as a hedge against inflation, risk assets and a falling U.S. dollar, finished the year up 62.46%. Silver was up 138.63% for the year.

Investors must ask whether this significant price rally across the precious metals was appropriate, assuming they are used for hedging purposes. Global equity markets remained strong as the S&P 500 Index rose 17.88%. Inflation remained stable in the 2.5%-3.5% range and the U.S. dollar declined a moderate -9.37%. Investors will need to consider if the 62% rally in gold was fundamentally justified.

Speculative interest and momentum trading may have fueled a portion of the significant rally in precious metals. If this strong technical momentum fades or reverses direction, investors should be prepared.

WTI Crude Oil has remained in a sustained downtrend over the last few years and trades near the $55-$60 range as OPEC+ and U.S. oil supply outpace demand. Prices remain suppressed and could force higher-cost producers to cut output to preserve margins.

The U.S. government recently captured Venezuelan President Nicolás Maduro and announced plans to revitalize the country’s oil industry using American energy companies. This could create a potential influx of oil supply that may further pressure prices, but this rebuilding would take time.

As the global economy continues to expand, investors will need to monitor global oil supply and demand dynamics, including any potential impact from U.S. involvement in Venezuela.

WTI Crude Oil Price

Currency Markets

After a brief rally coinciding with the risk-off sentiment surrounding the U.S. government shutdown period in Q4, the dollar has fallen back toward the lower end of its 2025 range. The U.S. Dollar Index declined -9.37% for the full year 2025.1

There has been somewhat of a global bond yield shift as the yield advantage of U.S. Treasuries has declined relative to bonds in Europe and specifically Japan, where yields have reached multi-decade highs. Foreign investors may now have less incentive to chase U.S. yields and could increasingly keep their capital in their own domestic markets.

This global bond yield dynamic could put additional pressure on the U.S. dollar as capital flows to the U.S. may not be as aggressive as they had been in the past. The dollar is still anticipated to remain a “safe haven” currency, but it might need a spike in financial market volatility to reverse materially higher from current levels.

SOURCES

- Morningstar Direct. Performance provided as total returns. U.S. Mid Caps is defined by the Russell Mid Cap TR USD index. U.S. Small Caps is defined by the Russell 2000 TR USD index. U.S. Growth is defined by the Russell 3000 Growth TR USD index. U.S. Value is defined by the Russell 3000 Value TR USD index. International Developed is defined by the MSCI EAFE NR USD index. Emerging Markets is defined by the MSCI Emerging Markets NR USD index. U.S. Agg Bond is defined by the Bloomberg U.S. Aggregate Bond TR USD index. U.S. Investment Grade Corp is defined by the Bloomberg U.S. Corporate Investment Grade TR USD Index. U.S. High Yield is defined by the Bloomberg High Yield Corporate TR USD index. Broad Commodities is defined by the Bloomberg Commodity TR USD index. WTI Crude Oil is defined by the Bloomberg Sub WTI Crude Oil TR USD Index. Gold is defined by the Bloomberg Sub Gold TR USD Index. Industrial Metals is defined by the Bloomberg Sub Industrial Metals TR USD Index. Short-Term Treasuries defined by the Bloomberg 1-3 Yr U.S. Treasury TR USD index. Intermediate-Term Treasuries defined by the Bloomberg Intermediate U.S. Treasury TR USD Index. Long-Term Treasuries defined by the Bloomberg Long-Term U.S. Treasury TR USD Index.

- U.S. Bureau of Economic Analysis. Gross Domestic Product, 3rd Quarter 2025 (Initial Estimate) and Corporate Profits (Preliminary). 12/23/25. Retrieved from https://www.bea.gov/news/2025/gross-domestic-product-3rd-quarter-2025-initial-estimate-and-corporate-profits

- U.S. Federal Reserve. Federal Open Market Committee Economic Projections. 12/10/25. Retrieved from https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20251210.htm#xt1p1f4

- U.S. Bureau of Economic Analysis, Personal Consumption Expenditures Excluding Food and Energy (Chain-Type Price Index) [PCEPILFE], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/PCEPILFE, January 6, 2026.

- FactSet. Earnings Insight. 12/19/25.

- U.S. Department of the Treasury. Daily Treasury Rates. Retrieved from home.treasury.gov.

- TradingView.com. WTI Crude Oil. Retrieved from https://www.tradingview.com/chart/S5oI8Odc/?symbol=TVC%3AUSOIL 1/6/26.

Eric Kulwicki, CFA®, CFP®, brings 20+ years of experience, currently serving as an independent investment consultant, portfolio manager, and wealth advisor for institutional and retail clients. On KulwickiInsights.com, Eric shares his timely perspectives on financial markets, investment strategies, and other financial topics. He also offers online investment education courses for beginner and intermediate investors, and coaching sessions for DIY investors seeking professional guidance.