To Convert or Not to Convert...

That is the Question

It’s that time of year again when investors with Traditional IRAs consider converting some (or all) of those IRA assets to a Roth IRA.

One of the most common questions we get asked involves the strategy of converting a Traditional IRA to a Roth IRA. While financial headlines often paint this as a universally smart move, the reality is that the decision is rarely black and white. Knowing folks with vastly different income levels and balance sheets, I can tell you that this is one of the most personal financial moves you can make. It relies almost entirely on the specific nuances of your life, meaning what works perfectly for your neighbor might actually be a mathematical mistake for you.

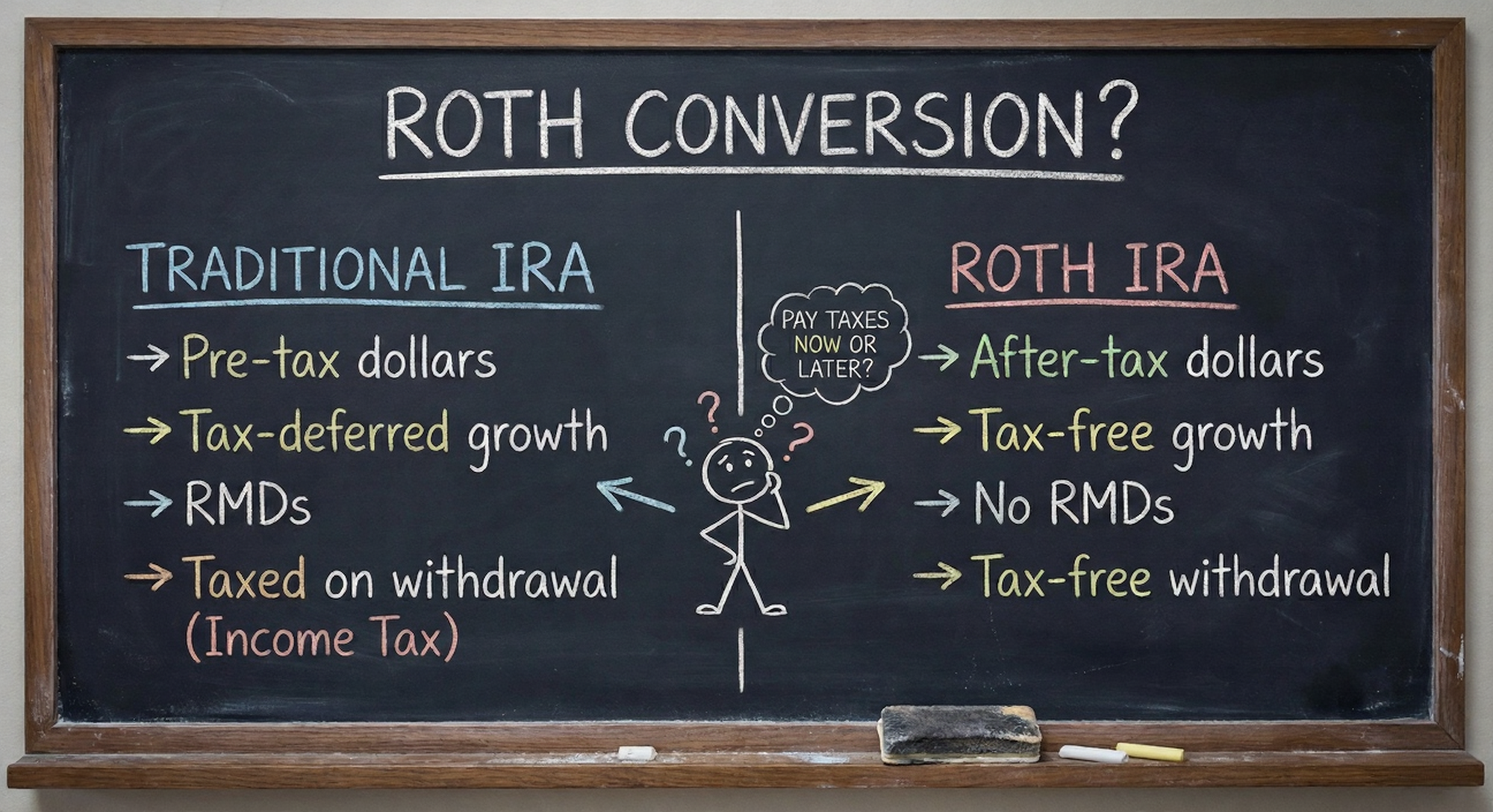

The core of this decision comes down to a comparison of tax rates and your willingness to make a bet on the future. You have to ask yourself if you would rather pay the tax bill on that money today at your current known tax rate or gamble on what your tax rate might look like in retirement. This involves analyzing your current income and trying to forecast what the tax environment will look like ten or twenty years down the road. You are essentially volunteering to take a hit to your wallet now to secure tax-free growth for the future, but that only makes sense if the math works in your favor.

You should also think beyond your own timeline and consider the people who might eventually inherit these assets. A major part of the strategy involves deciding whether you want to absorb the tax cost yourself so your spouse, children or or other beneficiaries do not have to deal with it later. By converting now, you might be saving your beneficiaries from a massive tax headache during their own peak earning years. It comes down to whether you want to leave them a tax-free gift or a portfolio that still has a hefty mortgage to Uncle Sam attached to it.

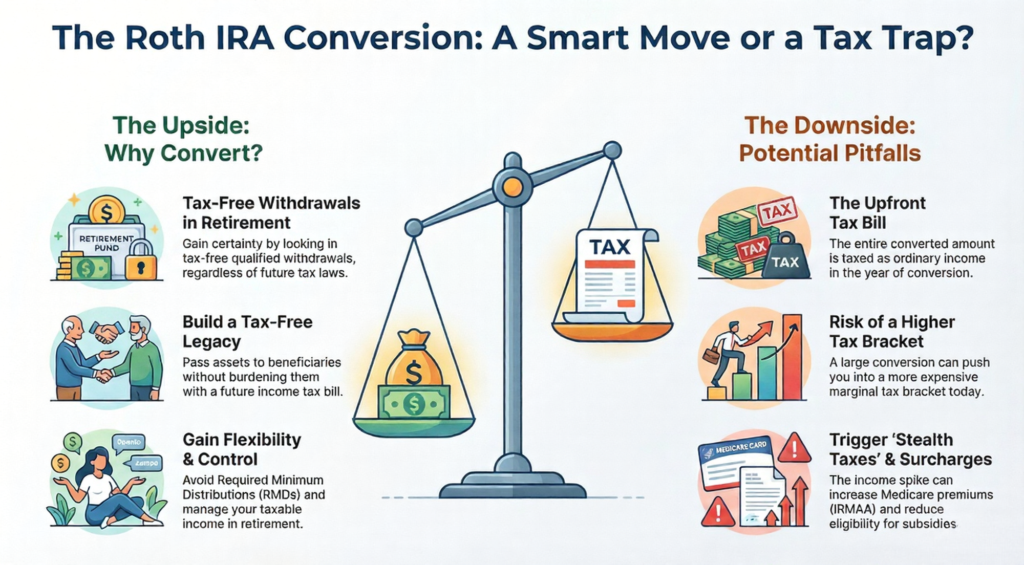

Here is a breakdown of the potential pros and cons to help you weigh your options.

Potential Pros

- Tax-Free Withdrawals: Qualified withdrawals (contributions and earnings) from a Roth IRA in retirement are tax-free, providing tax certainty regardless of future tax laws.

- No RMDs: The original owner of a Roth IRA is exempt from Required Minimum Distributions (RMDs), allowing the money to grow tax-free indefinitely.

- Tax-Free Wealth Transfer: Roth IRA assets can be passed to a spouse, who can roll the assets into their own Roth IRA or treat them as an inherited IRA. This transfer is tax-free. When the spouse passes the assets to non-spouse heirs (e.g., children), those assets are subject to the 10-year distribution rule under the SECURE Act (for most beneficiaries), but distributions within that 10-year period remain income tax-free. This allows the family to transfer a significant amount of wealth, including all compounded earnings, without incurring federal income tax.

- Tax Diversification: Creates a bucket of tax-free assets, allowing you to control your taxable income in retirement by choosing which accounts to draw from.

- Protection Against the “Widow’s Tax”: Allows a married couple to pay the conversion tax now at the generally lower Married Filing Jointly rates, protecting the surviving spouse from being forced into higher Single tax brackets later.

- “Locking in” Tax Rates: Converts assets today while you can manage your Marginal Tax Rate (e.g., filling up the tax bracket) to avoid paying potentially higher rates later.

Potential Cons

- Immediate Tax Liability: The entire converted amount is treated as ordinary taxable income in the year of conversion. You should have funds ready to pay this tax bill from non-retirement savings.

- Higher Marginal Tax Rate Risk: A large conversion can push your income into a significantly higher Marginal Tax Bracket (e.g., from 24% to 32%), making the conversion costly in today’s dollars.

- Irrevocability: Conversions are final. You cannot re-characterize (undo) a Roth conversion if market values drop after you’ve paid the tax.

- Medicare Premium Surcharges (IRMAA): The temporary spike in Adjusted Gross Income (AGI) from the conversion can trigger the Income-Related Monthly Adjustment Amount (IRMAA), resulting in significantly higher Medicare Part B and Part D premiums two years later. Roth conversions before Medicare support is received can potentially reduce the negative impact of Roth conversions and/or RMDs (generating higher AGI) later in life.

- Increased Social Security Taxation: Higher AGI increases your Provisional Income, potentially causing 85% of your Social Security benefits to become taxable, drastically raising your Effective Tax Rate for that year. Roth conversions before Social Security support is received can potentially reduce the negative impact of Roth conversions and/or RMDs (generating higher AGI) later in life.

- Loss of Subsidies: The AGI spike can eliminate eligibility for subsidies like the ACA Premium Tax Credit or affect college financial aid calculations.

- The 5-Year Rule: Converted funds must be held in the Roth IRA for five full years before they can be withdrawn tax-free and penalty-free, even if you are over age 59 ½.

If you or someone you know would like to learn more about Roth IRA conversions, please reach out to the Horizent Team at Intrua Financial.

This information is for general educational purposes only and does not take into account your personal tax or financial situation. Intrua does not provide tax or legal advice. You should consult your tax professional before making a Roth conversion.

Eric Kulwicki, CFA®, CFP®, brings 20+ years of experience, currently serving as an independent investment consultant, portfolio manager, and wealth advisor for institutional and retail clients. On KulwickiInsights.com, Eric shares his timely perspectives on financial markets, investment strategies, and other financial topics. He also offers online investment education courses for beginner and intermediate investors, and coaching sessions for DIY investors seeking professional guidance.